You are leaving girlscouts.org for a website opened by an external party. You will be subjected to the privacy and security policies of the website

Learn more about banking and finances.

Your one-stop shop for help managing troop, community/area, and Juliette banking and all money-earning activities.

As a steward of your troop’s money, you have a wonderful opportunity to teach Girl Scouts about business and financial literacy skills that will serve them throughout their lives.

Your Girl Scout troop will plan and finance its own activities, and you’ll coach your troop members as they earn and manage troop funds. Troop activities are powered by proceeds earned through council-sponsored product program activities (such as the Girl Scout Cookie Program), money-earning activities, and any dues your troop may charge.

Remember that all funds collected, raised, earned, or otherwise received in the name of and for the benefit of Girl Scouting belong to the troop and must be used for the purposes of Girl Scouting. Funds are administered through the troop and do not belong to individuals.

Opening a Girl Scout Bank Account

No matter how much money your Girl Scouts River Valleys troop, community, area, or group plans to earn or spend, you’ll need a safe place to deposit your troop dues, product program proceeds, and other funds. If you’ve stepped up to lead an existing troop, community, area, or group, you may inherit a checking account, but with a new troop, community, area, or group, you’ll want to open a new bank account.

Be sure to review and understand Girl Scouts River Valleys Banking and Money Management Policy.

Important Bank Account Guidelines and Information

All money and other assets, including property, that are raised, earned, or otherwise received in the name of or for the benefit of Girl Scouting becomes the troop, community, area, or group’s property and does not belong to individual girls, volunteers, or parents/guardians. Such money and other assets must be used for the purposes of Girl Scouting and should equally benefit all members of the troop, community/area, or group.

All expenses, reimbursements and debit card transactions should always have supporting receipts and documentation. Volunteers must never issue reimbursements to themselves.

On-going communications between bank account signers will ensure account activity reconciles with bank statements monthly.

Financial status must be regularly discussed among all troop, community, area, or group leadership, Girl Scouts, and parents to ensure transparency regarding use of funds.

Do not use your personal social security number to open your Girl Scout account. All bank accounts are opened as a business checking account, using GSRV Tax ID number.

Girl Scout bank account must never be used to hold personal funds or for making personal purchases. All Girl Scout funds must be deposited directly into a Girl Scout bank account, never a personal account.

Some banks may request to run a credit report on signers for the account using the signer’s social security number. This is a standard procedure for most banks and credit unions when opening a business account and is for their purposes only. GSRV does not have access to any information from the credit reports.

Savings accounts, Certificates of Deposits (CD’s), Money Markets or financial interest-bearing accounts are not permitted for Girl Scout banking.

Bank account signers will be held accountable for all financial activity. GSRV reserves the right to audit or close Girl Scout bank accounts without consent of the account signers at any time.

Girl Scout account financial records (e.g. bank statements, finance reports, bank receipts, cash disbursements, etc.) must be retained for seven years.

Troops, communities, areas, or groups must submit an annual Girl Scout Finance Report outlining income and expenses to Girl Scout River Valleys by June 30. Utilize the Finance Tracker (XLSX) to track your income and expenses.

If you are accepting checks, please be aware of Girl Scouts River Valleys Check Acceptance Statement:

Checks accepted only upon the condition that customer agrees that if any check is returned unpaid, a $30 service fee will be added to all dishonored checks. A debit for the amount of the check and the $30 service fee may be processed electronically without further notice to customer. Additional civil penalties may be imposed on checks returned for a non-payment after 30 days. Central Resources 800-951-7188

Pick Your Co-Signers

Determine who will be the two signers for the troop, community, area, or group bank account.

Signer Prerequisites:

- All bank accounts require a minimum of two signers.

- Each signer needs to have an active membership.

- Each signer needs to have an eligible and current (within 2 years) background check on file.

- Each signer must have role assigned to troop, community, area, or group.

- Signers cannot be related by blood or marriage.

- Signers cannot share a household.

- Signers must be at least 18 years old.

- Each signer will need to read, acknowledge, and sign the Girl Scout River Valleys Bank Account Agreement form (link).

One signer should keep the debit card/checkbook and handle transactions while the other signer receives the bank statement to verify transactions.

Where to Bank and How to Open a Girl Scout Bank Account

Read more information on where and how to open a Girl Scout bank account.

Still Have Banking Questions?

For questions about Girl Scout banking, please contact Becky Rettler, Troop Finance Specialist at girlscouts@girlscoutsrv.org or 800-845-0787.

Finance Forms and Documents

Forms

Cookie Credits, Fall FUNds, and Juliette Program Credit Reimbursement Form

Finance/Inventory Issue Form and FAQs

Financial Assistance Form

Girl Scout Bank Account Record Form

Girl Scout Finance Report

Program Credit and/or 2025 Happy Camper Coupon Code Redemption Form

Bank Account Request Form

Troop Disband Form

Documents

Bank Account Signer Agreement (PDF)

Certificate of Exemption – Minnesota Revenue (PDF)

Certificate of Exemption – Wisconsin Sales (PDF)

Event Budget Excel Worksheet (XLSX)

Financial and In-Kind Donation Form (PDF)

Girl Scouts River Valleys W9 Form - signed (PDF)

Juliette Program Credit Deposit Sheet (PDF)

Troop Finance Tracker (XLSX)

Juliette Girl Scout Money Management

In accordance with the Internal Revenue Service and Girl Scouts of the USA, Juliette Girl Scouts are not allowed to have bank accounts or hold cash. Therefore, Juliette Girl Scouts may hold funds in the form of council issued Juliette Program Credits.

Download and return the Juliette Program Credit Deposit Sheet (PDF) if a Girl Scout in your troop is transferring to a Juliette (individual Girl Scout) status or if a Juliette earned money.

All About Juliette Girl Scouting

Girl Scout Juliettes are registered girl members, in grades K-12, who are not affiliated with a troop and complete Girl Scout activities with the guidance of an adult mentor. This article outlines how Juliettes can participate in a way that fits their schedule and participate in activities that meet their needs and interests.

Why Participate as a Juliette?

There are many advantages to participating in Girl Scouts as a Juliette.

Juliettes:

Gain leadership experience.

Can participate in all Girl Scout activities individually, so they can tailor their experience.

Create a well-rounded Girl Scout experience by completing the planning guide for their grade-level on their own time.

Serve their community through individual community service projects and Take Action projects.

Have opportunities to connect with other Girl Scouts through council sponsored virtual and in-person events.

What Can a Juliette Do?

Girl Scout Juliettes can do anything Girl Scouts in a troop can do. Juliettes learn to Discover, Connect, and Take Action when they:

Complete Girl Scout Journeys and Badges

Girls can choose from different Journey books at each program grade level. Journeys guide Girl Scouts towards becoming leaders in their community. Juliettes can also earn badges, which include a variety of skill-building activities, many of which complement the Journeys.

Attend Girl Scout Events and Activities

Juliettes can meet other girls in their area while completing Journeys, earning badges, and learning more about the outdoors, STEM, healthy living, and entrepreneurship at council-sponsored events. Communities/areas also offer many events which are great ways for Juliettes to meet other Girl Scouts in their area. New this year to Girl Scouts River Valleys will be exclusive Juliette Girl Scout virtual meetups and programs.

Help Others Through Community Service

Part of the Girl Scout Law is to “make the world a better place.” Juliettes can work on their own or with their Girl Scout community to carry out this tradition. Juliettes can also pass along what they’ve learned, gain leadership skills, and earn special mentoring awards by helping younger Girl Scouts at troop meetings, events, camp, and more.

Participate in the Girl Scout Cookie Program or the Fall Product Program

Just like Girl Scouts in troops, Juliettes can fund their Girl Scout activities while learning business skills like goal-setting, decision-making, money management, people skills, and business ethics when they participate in the Cookie Program or the Fall Product Program (Snacks & Magazines sale).

Earn Girl Scouting’s Highest Awards

The Gold, Silver, and Bronze Awards are the highest awards in Girl Scouting. Juliettes can earn these awards too by leading a Take Action project to improve their local community.

Travel with Girl Scouts

Juliettes can experience leadership opportunities and cross-cultural understanding through regional, national, and international travel. Learn more about traveling with Girl Scouts.

Girl Scout Juliette Mentors

A Girl Scout Juliette mentor is a parent or trusted adult who guides a Juliette through their experience. Mentors are provided support customized to the Juliette’s grade level. Juliette mentors are invited to join Rallyhood where they will have access to the most up to date program opportunities, including activity plans to earn badges and journeys, Juliette mentor resources, and a calendar of events to enhance the Juliette Girl Scout and mentor experience.

Register as an adult member of Girl Scouts.

Seek out and relay information and opportunities for their Girl Scout.

Help plan their Girl Scout year using the Troop Year Planner.

Connect with their community/area volunteer team for opportunities to meet other Girl Scouts and participate in local events.

Follow Volunteer Essentials (PDF) and Safety Activity Checkpoints (PDF) to keep their Girl Scout safe.

Connect with other mentors in their community/area.

Juliette Program Credits

Because individual Girl Scouts are not eligible to hold a bank account like troops do, they receive Juliette Program Credits (JPCs) from selling cookies during the cookie sale and items during the Snacks & Magazines sale. They can also convert money from money-earning activities, or from a previous troop into JPCs by using the deposit sheet (PDF).

JPCs can be used at Girl Scouts River Valleys’ shops, camps, and for programs. For other Girl Scout activities, girls can turn in JPCs with receipts and a Cookie Credits, Fall FUNds, and Juliette Program Credit Reimbursement Form.

Earning Money Through Product Programs

The Girl Scout Cookie and Fall Snacks & Magazines Programs should be the primary way Girl Scouts earn money for programs and activities. Once the money comes in from participating in either of these programs, funds can be used for troop expenses. If the budget goal for a specific activity has not been met through product sales, Girl Scouts may participate in supplemental money-earning projects.

Cookie Program

The Cookie Program (February-March) is the largest girl-run business in the world. Participation in the program teaches girl financial literacy and business skills.

Fall Snacks & Magazines Program

The fall Snacks & Magazines Program lasts for four weeks beginning the end of September and ending near the end of October. Sales are limited to family and friends and it’s a great way to add to the troop treasury, or for new troops to earn start-up funds.

Cookie Credits, Fall FUNds, and Juliette Program Credits

Girl Scouts earn Cookie Credits from the Cookie Program, Fall FUNds from the Fall product program and both credits being used for extended council-approved troop trips or lifetime membership have an extended expiration date for two more years. In addition, Juliette Girl Scouts earn Juliette Program Credits for both programs. Each of these program credits can be used to help pay for day camp, resident camp, Girl Scout Gold and Silver Award projects, and other Girl Scout activities. In the spirit of planning, girls should make decisions as to how they will use their Cookie Credits and Fall FUNds—whether for their own use or for the benefit of the troop.

See Cookie Credits & Fall FUNds Policy, Rewards for Cookie Sellers, and Rewards For Fall FUND Raisers along with your Girl Scout(s) to choose how credits will be used.

Both types of rewards expire mid-September in the year following the program season during which they were earned. For example, 2026 Cookie Credits will expire September 15, 2027. Both credits being used for extended council-approve troop trips or lifetime membership have an extended expiration date for two more years. Juliette Program Credits do not expire.

ACH (Automated Clearing House) Frequently Asked Questions

An automated clearing house (ACH) is when a third party (in this case, Girl Scouts River Valleys) needs to either withdrawal or credit a troop’s bank account electronically.

How does an ACH work?

Troops simply deposit all money collected (either from Snacks & Magazines or the Cookie Program) into their troop’s bank account. Then, on scheduled dates, money will be withdrawn from the troop’s bank account into Girl Scouts River Valleys’ bank account.

When are the scheduled ACH withdrawals and deadlines?

Snacks & Magazines Program

Dec. 1, 2022 | Deadline date for families to turn in money into troop |

Dec. 8, 2022 | Deadline date to deposit money into troop’s bank account |

Dec. 8, 2022 | Deadline date to submit a Finance/Inventory Issue Form for any money collection issues |

Dec. 21, 2022 | FINAL Refund Automated Clearing House (ACH) to troop account for proceeds due to troop |

Dec. 16, 2022 | FINAL Balance Automated Clearing House (ACH) withdrawal from troop bank account processed by Girl Scouts River Valleys |

Cookie Program

Mar. 10, 2023 |

Girl Scouts River Valleys will run report to determine first ACH amount |

Week of Mar. 13, 2023 |

Emails sent to troops with First ACH withdrawal amount |

Mar. 14, 2023 |

Deadline date to deposit money into troop’s bank account for first ACH withdrawal |

Mar. 17, 2023 |

FIRST Automated Clearing House (ACH) withdrawal from troop bank account processed by Girl Scouts River Valleys |

Week of Mar. 20, 2023 |

Smart Cookies will be updated to reflect the ACH withdrawal |

Apr. 1, 2023 |

Deadline date to deposit money into troop’s bank account |

Apr. 1, 2023 |

Deadline date to submit a Finance/Inventory Issue Form for any money collection issues or excess inventory issues |

Apr. 21, 2023 |

FINAL refund Automated Clearing House (ACH) to troop account for proceeds due to troop |

Week of Apr. 24, 2023 |

Emails sent to troops with Final ACH withdrawal amount |

May 3, 2023 |

FINAL Balance Automated Clearing House (ACH) withdrawal from troop bank account processed by Girl Scouts River Valleys |

Week of May 8, 2023 |

Smart Cookies will be updated to reflect ACH withdrawal |

How is ACH amount determined?

Snacks & Magazines Program

The amount that will be withdrawn from the troop’s bank account is the final balance amount owed to Girl Scouts River Valleys that is reflected in M2OS.

Cookie Program

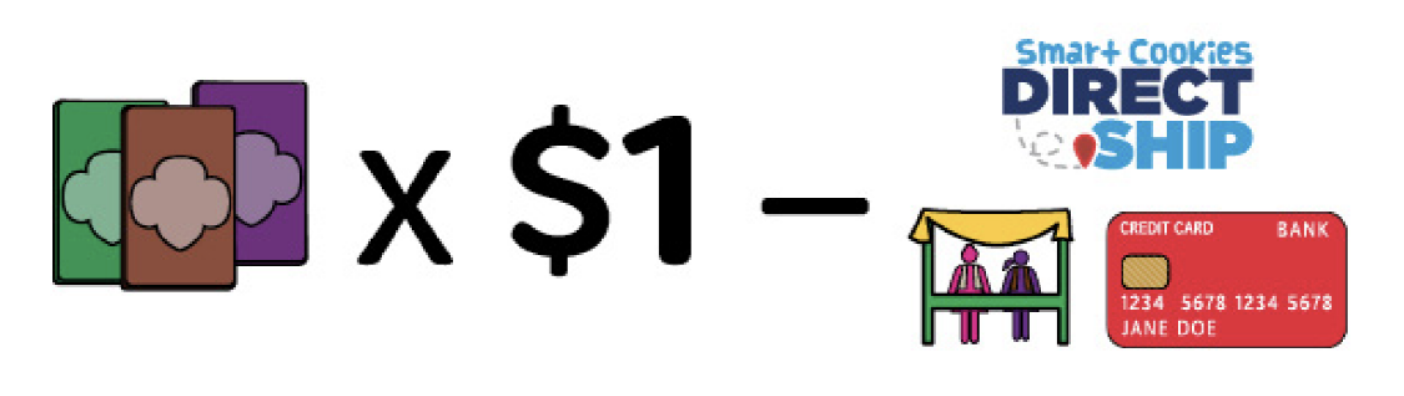

The first ACH withdrawal will be calculated by multiplying $1 by the total packages received by the troop as of March 10, 2023, minus any credit card payments made through Smart Cookies.

Example 1: If the troop’s Total Packages Received in Smart Cookies is 846 packages as of March 10, 2023, then Girl Scouts River Valleys will withdrawal $846 from the troop’s bank account.

Example 2: If the troop’s Total Packages Received in Smart Cookies is 846 packages as of March 10, 2023 and the troop had $200 in Smart Cookies Direct Ship, booth, and/or girl delivery credit card orders, then Girl Scouts River Valleys will withdrawal $646 from the troop’s bank account.

On May 3, 2023, the final ACH withdrawal will be the total that is in the Balance box on the Troop Balance Summary Report.

Does My Troop Have to Have a Bank Account to Participate in ACH?

Yes. All troops, except Juliette Girl Scouts, participating in either the Snacks & Magazines or Cookie program must have a troop bank account to deposit money collected from families and for the ACH to be processed.

Juliette Girl Scouts are the exception as they are not allowed to have bank accounts. Juliettes deposit their money into the Girl Scouts River Valleys Wells Fargo account using a special encoded deposit ticket, which is provided to them at the beginning of the program. Due to Girl Scouts of the USA and IRS regulations, Juliette Girl Scouts cannot keep proceeds as cash on hand or have checking/savings accounts in their name. Additionally, Juliette money cannot be deposited into parent or guardian’s personal account.

What if my troop’s bank account is not through Wells Fargo?

Your troop’s bank account does not need to be through Wells Fargo for an ACH withdrawal to be processed. An ACH withdrawal can occur between any financial institutions.

How often should deposits be made?

We encourage troops to make money deposits weekly. To keep the money safe and secure, it is in the best interest of the troop for money to be deposited frequently. It is also in the best interest for the customers as it minimizes the amount of returned checks (non-sufficient funds, closed accounts).

Does the person making the deposits into the troop’s bank account need to be a signer on the account?

No. The troop leader will need to make sure whoever is making deposits has the troop’s bank account number and/or deposit tickets for the troop’s bank account. Cash deposits made by a non-signer may need to provide photo ID when making deposit.

Can a troop pre-determine the amount pulled from their account?

No. The ACH amount is pre-determined by the formula listed above and cannot be adjusted.

Can a troop have the money withdrawn out earlier then predetermined dates?

Yes. If your troop has a large balance in the account and would like Girl Scouts River Valleys to withdraw the money prior to the pre-determined dates, you can call 800-845-0787 and talk to Troop Finance Specialist, Becky Rettler.

To whom are checks written out and how do we endorse checks for deposit?

Checks must be written out to Girl Scouts and endorsed “for deposit only” when depositing.

What should I do if I know money will not be in the bank for the scheduled ACH?

Timely and regular communication among the leadership of the troop is a vital component for the success of ACH with your troop. However, we understand that emergencies do happen. If you find that this is the case, the troop will need to complete the Finance/Inventory Issue Form by the dates listed in the guidebooks and online.

If the money is not in the troop’s bank account when the ACH withdrawal is processed, what happens?

If the troop bank balance does not have sufficient funds to cover the ACH withdrawal, a non-sufficient funds charge may be incurred. Girl Scouts River Valleys will not reimburse troops for these charges. Girl Scouts River Valleys will contact the troop leader and/or cookie manager regarding the returned ACH via email and arrange for payment.

Can families or troop leaders deposit money into their personal account and then write a check to the troop?

Parents and troops can use Venmo, Cash App, and PayPal Friends and Family apps to collect transfer funds to troop account but not a personal check.

What if our troop is only participating in online orders for Snacks & Magazines and/or the Cookies Program?

The money paid for online Snacks & Magazines and Cookies is automatically deposited into Girl Scouts River Valleys’ bank account and then is credited to the troop in M2OS and Smart Cookies.

If your troop is only participating in online orders and is due a refund for troop proceeds earned, Girl Scouts River Valleys will process that refund to the troop bank account via ACH.

Will M2OS and/or Smart Cookies be updated to show the ACH from the troop bank account?

Yes, the ACH withdrawal amounts will be reflected in M2OS and Smart Cookies 1-2 days after the money is withdrawn from troop’s bank account.

What if we accidentally deposit money into the council’s bank account instead of the troop’s bank account?

Contact Troop Finance Specialist, Becky Rettler at becky.rettler@girlscoutsrv.org as soon as possible to make sure the funds have been credited to the troop. ACH withdrawal will be adjusted, instead of Girl Scouts River Valleys transferring the money to the troop’s bank account and then having to transfer the money back for the ACH.

Supplemental Money-Earning Projects and Ideas

Before implementing any money-earning project, please refer to our Money Earning Policy, Safety Activity Checkpoints (PDF), and the Managing Group Finances section of Volunteer Essentials (PDF).

Girl Scouts must be involved in planning and implementing the project.

Money-earning projects are for troops only. Communities/areas are welcome to support and assist in the planning, but all proceeds must go back to individual troops.

Additional money-earning projects cannot take place during the Cookie Program or Snacks & Magazines sales periods.

Girl Scouts must receive 100 percent of the proceeds from any money-earning activity; and funds raised must belong to the troop as a whole (they cannot be refunded or redeemed by an individual member).

Troops cannot take orders for, sell, or endorse commercial products or businesses of any kind (this includes Mary Kay, Tupperware, Candle Lite, Culvers, and coupon programs). However, they can sell wholesale, non-branded, or homemade items.

Troops cannot use paid advertising or the Internet to promote their project. They are encouraged to use signs, fliers, and word of mouth.

Projects must not be conducted on a door-to-door basis (with the exception of the Cookie Program).

For projects involving food, troops must follow state food safety guidelines and, in some cases, purchase a food license:

Minnesota Department of Health – Follow these guidelines for food stand/community dinner projects in Minnesota.

Minnesota Department of Agriculture – Follow these guidelines for bake sales in Minnesota.

Iowa Department of Public Health – Follow these guidelines for food stand/community dinner projects in Iowa.

Wisconsin Department of Health Services – Follow these guidelines for food stand/community dinner projects in Wisconsin.

Project Ideas

Create Inexpensive, Meaningful Experiences

Remember, you don’t need to spend money for your troop to have a fun and meaningful Girl Scout experience. They will remember their troop mates, leaders, nature walks, learning, and all the little moments that didn’t cost a thing!

Money-Earning Project Ideas

Sell crafts and goods:

Garage sale

Calendars, cookbooks, or bird feeders/houses

Wreath, flower, plant, or tree sale (items must be wholesale/non-branded)

Concession stand (must have appropriate food license and receive 100 percent of the profits)

Cookie or cocoa mix in a jar (must have appropriate food license, if applicable)

Charge or accept donations for services:

Babysit at special events (with an adult who is First Aid and CPR certified), tutor others, or walk dogs

Wash cars, rake lawns, or shovel sidewalks

Bag groceries or gift wrap for donations (cannot replace a paid employee’s regular position)

Referee at sporting events

Offer clown activities or face painting at community or school events

Organize a fall or international festival (accept donations or charge a small fee)

Community dinner or breakfast (must have appropriate food license and follow promotion guidelines)

Facilitate badge/patch workshops for younger troops

Facilitate a recyclable drive (i.e., cans, paper or ink cartridges)

Take and distribute holiday photos

Charge or accept donations for productions like haunted houses, talent shows, sock hops, or dances in the community

Financial and In-Kind Donations

Sponsorships and donations are mutually beneficial partnerships between Girl Scout troops and businesses, schools, communities of faith, and other organizations. Use the Financial and In-Kind Donation Form (PDF) to document donations to your troop or community/area.

The following sponsorship and donation guidelines must be adhered to:

Raffles, silent auctions, games of chance, and direct solicitation of cash are not approved activities.

Troops may not ask large corporations or chains for donations; however, they may ask local businesses to donate in-kind materials (like supplies or food for an activity).

Troops cannot raise money for another organization or charity; however, girls may choose to donate a portion of the proceeds they earn to a charity of their choice.

Buy Tax-Fee

Girl Scouts is a nonprofit organization meaning, in most cases, troops do not have to pay sales tax for purchases made for troop activities, meeting supplies, and other typical expenses. Examples of exceptions to this would be prepared food or lodging, or a car rental on a troop trip.

To buy tax-free, provide the following Minnesota and Wisconsin state taxes to merchants to validate tax-exempt status:

Minnesota Revenue Certificate of Exemption (PDF)

Wisconsin Sales Tax Certificate of Exemption (PDF)

Record and Report

To make records and reporting easy, do not mix personal and troop funds and don’t use the troop checkbook for non-troop transactions. Save receipts from all troop activities and purchases and check your bank statements frequently with your receipts. Keeping good financial records ensures you have the necessary documentation, especially in the case of any issues.

Use the Troop Finance Tracker to help with your record keeping.

Every June, troop leaders (and communities/areas) are required to complete the Girl Scout Finance Report to make sure that proper records of funds are maintained and kept on file at the council office.

Troop Disbands, Transfers, Splits and Mergers

It is not uncommon for troops to change, move around, or disband. If this happens to your troop, follow these instructions regarding the troop’s money.

Disbanding Troops

Before a troop disbands, the troop is encouraged to use the existing money for activities. If funds are left, money is to be turned over to the council. A troop leader must submit a Troop Disband Form, along with confirmation of closure or zero balance of any and all troop bank accounts within thirty days of the last troop activity as registered Girl Scout members.

Troops must comply with the Troop Funds Distribution Policy as they disband.

Transfers and Changes

If one of your Girl Scouts leaves your troop, they relinquishes any claim on money they helped earn for the troop. If the Girl Scout is bridging, transferring to another troop, or becomes a Girl Scout Juliette*, the original troop has the option–though encouraged as a gesture of goodwill and sisterhood–to send the Girl Scout with a portion of the money for her next Girl Scout adventure.

To do this, the funds should be divided proportionally to the number of Girl Scouts in the troop. The troop of the transferring girl should receive one of the proportionally divided funds (payable to the new troop, not the Girl Scout or caregiver).

*Juliettes have program credits instead of checking accounts. If your transferring Girl Scout is becoming a Juliette, mail a check to Girl Scouts River Valleys with a completed Juliette Program Credit Deposit Form (PDF). Juliette Program credits will then be sent to the Girl Scout in return.

Split or Merge

If a troop splits into multiple troops or merges into one troop, the original troop’s funds should be divided proportionally to the number of Girl Scouts in each new troop.

For example, a troop of thirty-five Girl Scouts splits into two distinct troops of seventeen and eighteen, respectively. The original troop has $350 in its treasury. Divide $350 by thirty-five Girl Scouts = $10 per girl. The funds are then distributed accordingly to the new troops: $170 to the new troop of seventeen and $180 to the new troop of eighteen.

If all Girl Scouts from one troop merge into another troop, all the funds from the old troop are to be transferred to the new troop.

Financial Assistance

Girl Scouts is an organization for all, and we do not want financial constraints to have any bearing on a member’s ability to wear their uniform proudly, attend council-events and camp, and do fun things with her troop.

Complete a financial assistance form for shop purchases, troop dues, camp, and events can be found online. Forms must be completed by a parent or guardian requesting assistance for their Girl Scout, or by the adult requesting assistance for themselves.

Managing Community/Area Money

Full guidance for community/area leaders or treasurers on managing community/area finances.

LEARN MORE